One of the most common questions we hear from providers is: “How do I set up the Worker Retention Payment (WRP) in my payroll system?”

Because different services use different systems (Xero, MYOB, QuickBooks, or others), there isn’t a one-size-fits-all process. But the principles are the same across all payroll platforms. The key is to make sure WRP is kept separate from ordinary wages, so it’s easy to track, reconcile, and report later. Once you’ve set it up properly, the payments you receive from the Department of Education will flow smoothly through your payroll and reporting processes.

Step 1: Create a dedicated WRP allowance item

The first step is to create a new pay category or “item” for WRP in your payroll software.

- Set it up as an allowance (not part of the base hourly rate).

- Name it clearly, for example: “WRP Allowance” or “Worker Retention Payment.”

- Make sure it is taxable and attracts superannuation like ordinary wages.

- Link it to ordinary hours worked so it calculates correctly each pay run.

This ensures WRP is applied consistently and can be tracked separately from wages.

💡 You should set up WRP in your payroll so it is clearly identifiable. This generally means creating: a single allowance line (e.g. “WRP Allowance”), or separate categories (e.g. “WRP – Regular” and “WRP – Backpay”). In addition, WRP must also be identifiable when applied to leave (e.g. a separate line such as “WRP/Leave”). The exact set-up will depend on your payroll system, but what matters is that WRP is clearly identifiable across regular hours, backpay, and leave entitlements.

⚠️ Important note:

Step 2: Apply the allowance to eligible employees

Once you’ve created the allowance item, apply it to every eligible employee.

- Eligibility depends on your workplace instrument — either the Multi-Employer Agreement (MEA) or Individual Flexibility Arrangements (IFAs).

- For new employees, ensure their IFA (or contract under the MEA) is signed before you add the allowance to their payroll profile.

- For employees who are not eligible for the grant, do not add the allowance.

This way, only the correct employees receive the payment, and your records stay compliant.

Step 3: Keep WRP separate for reporting

Keeping WRP as a separate line in your payroll is critical. It allows you to:

- Track exactly how much WRP you’ve passed on to staff.

- Reconcile against the payments you receive from the Department of Education.

- Prepare for the annual declaration in October, which requires you to show WRP spent on wages vs on-costs.

Providers who blend WRP into their base wage rate often struggle later when reporting or being audited — so keeping it separate will save you time and stress.

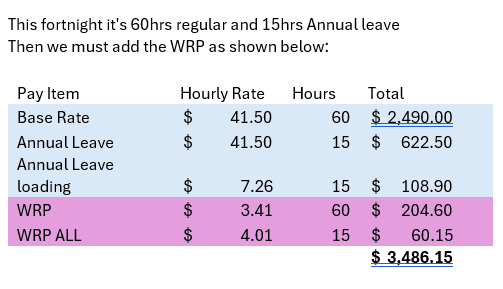

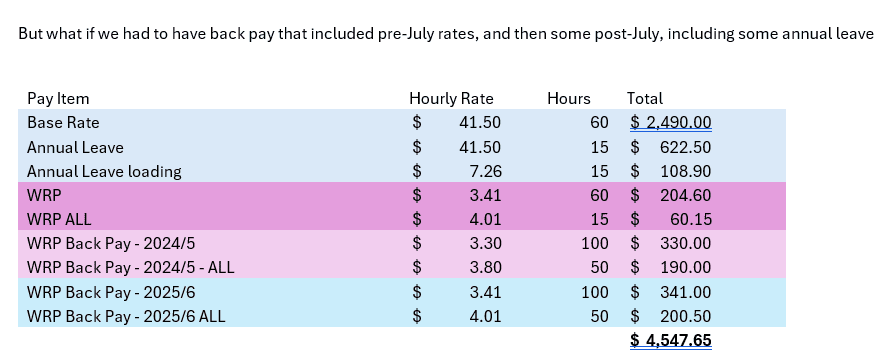

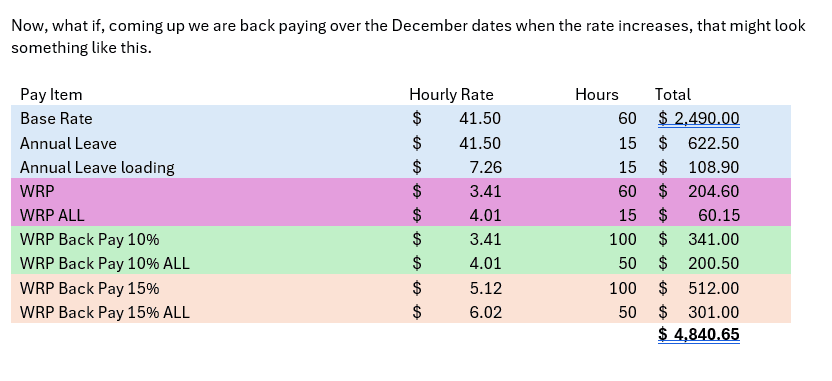

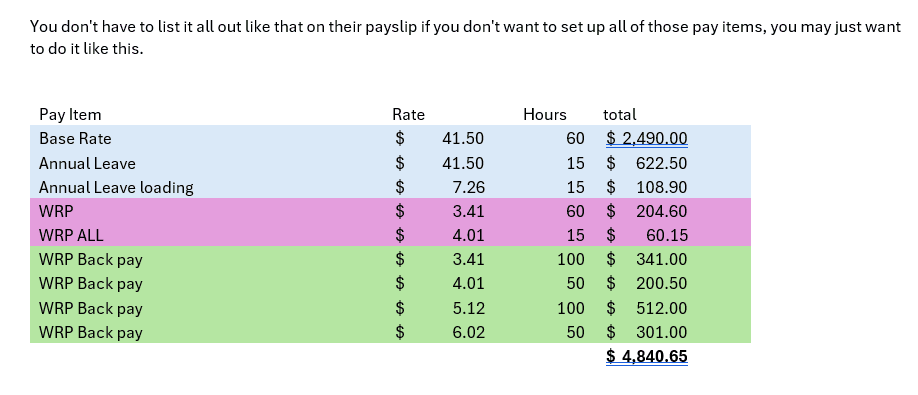

📊 Worked Examples from Payslips

These examples show how WRP appears in payroll when employees are paid above the Award rate (e.g. $41.50 vs Award base $34.10). Remember — WRP is calculated on the Award base rate ($34.10 → $3.41), not on the higher above-Award rate. WRP must also be applied to leave loading. That’s why you’ll see separate WRP/Leave lines in the payslip examples below.

1)

2)

3)

4)

Step 4: Process backpay and top-ups correctly

When you receive lump-sum backpay or monthly top-up payments, use the same WRP allowance item to process them.

This ensures these amounts are clearly recorded as WRP, not ordinary wages, and remain visible for reporting and compliance purposes.

Step 5: Review rates before increases

The WRP increases in two stages. The next increase begins on 1 December 2025.

Before that date, review your allowance amounts in payroll to make sure they reflect the updated WRP rates published in the grant guidelines.

Why this matters

Setting up WRP correctly in payroll helps you:

- Stay compliant with the Department of Education’s requirements.

- Provide clear evidence if audited.

- Avoid errors in reconciliation and annual reporting.

- Ensure your employees receive their WRP entitlements in full and on time.

Common mistakes to avoid

- Absorbing WRP into base wages: This makes it difficult to track and can cause compliance issues. Always keep WRP separate as an allowance.

- Forgetting new staff: New employees must sign an IFA or be covered by the MEA before being eligible. Add the WRP allowance at the same time.

- Not reviewing rates: Remember to update your WRP allowance before the December 2025 increase.

⚠️ Important note: The Australian Childcare Alliance (ACA) is not able to provide financial or accounting advice. We strongly suggest you work with your bookkeeper or accountant to ensure WRP is set up correctly in your payroll system. Each provider’s circumstances may be different, and professional advice will help you stay compliant.

Should you have any queries or concerns regarding the Worker Retention Payment please do not hesitate to reach out to our team on 1300 856 379 or via email at wrp@childcarealliance.org.au.