Understanding Back Pay in the WRP Context

The Worker Retention Payment (WRP) Grant funding can be backdated to 2 December 2024 for eligible providers who submit an application by 30 September 2025.

This means that eligible employees may be entitled to backpay once their employer receives WRP funding.

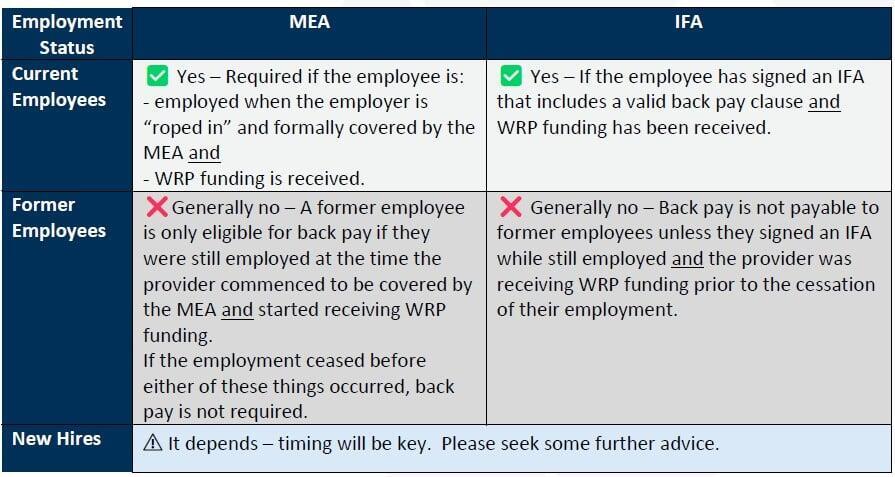

Back pay obligations differ depending on whether you are using the Multi-Employer Agreement (MEA) or Individual Flexibility Agreements (IFA) as your workplace instrument.

Note: If you are using your own Enterprise Agreement as your workplace instrument, you should contact our WRP Support Service team for some advice in relation to your specific circumstances.

Who Does Backpay Apply To?

(provided the provider sought payment for backpay).

- Former employees are generally not eligible for back pay unless they were employed at the time the provider’s application for “roping in” is approved by the Fair Work Commission and the WRP funding has been received.

- That being the case, there are only a fairly limited set of circumstances in which backpay might be triggered for former employees – for example, the provider receives Grant funding on 20 June and the employee’s employment ceases on 23 June. In this case, the employee was still employed at the time the funding was received. While they will not be employed by the time the provider has the opportunity to administer the backpay, they are still entitled to backpay.

- Employers may voluntarily decide to back pay former employees at their own discretion. If you make this election, we recommend the entitlement be applied fairly to all eligible staff (including former employees) to avoid potential industrial issues; i.e. the provider should avoid making backpay payments to some former employees but not others.

IFA Back Pay

- Once funding is received, providers are only obligated to provide backpay to eligible employees who are still employed at the time the WRP funding is received and have signed a valid IFA that includes a backdating clause to 2 December 2024.

- IFAs cannot be signed after employment ends, and IFAs signed before the employment ends cease to apply after this date. That being the case, if an employee signs an IFA but leaves prior to WRP funding being received, there is no legal obligation to provide back pay.

- Please note: ACA’s advice is based solely on the use of the official, unmodified IFA templates provided by our team. We are unable to provide guidance on IFAs that differ from our template.

Best Practice Advice

- Back pay may be processed before WRP funding is received; however, this would be at the provider’s own expense.

- Keep records of voter rolls (for MEA), signed IFA agreements, and employment start/end dates.

- Communicate early with staff about WRP participation and any intended backpay arrangements to avoid confusion or disputes.

If applying for historical leave liability funding, ensure leave balances are accurately recorded as at 2 December 2024, as this is a key requirement for that component of the WRP.

Important Note on Historical Leave Liability (HLL) Funding - 30 June 2025 Deadline

Providers who wish to apply for funding towards accrued historical leave liabilities (e.g. annual or personal leave owed as at 2 December 2024) must submit their WRP application on or before 30 June 2025.

- This earlier cut-off applies only to the HLL component of the grant.

- There has been no change to this date, even though the general backpay application deadline has been extended to 30 September 2025.

To be eligible for HLL funding:

- You must ensure that leave balances are clearly recorded as at 2 December 2024.

- Submit your WRP application, including any HLL claims, by 30 June 2025. (This may not necessarily be complete but you will need to indicate which workplace instrument you intend to use.)

Need Support?

Our Worker Retention Payment Support Service team at ACA National are available Monday to Friday from 9am - 5pm AEST.

We offer a free service to all early learning service providers - regardless of whether or not you are an ACA member.

You can reach out to our team on 1300 856 379 or via email at wrp@childcarealliance.org.au.

We look forward to helping you make the best decision for your service and ensuring you receive the support you need.